ON THE EFFECTIVENESS OF SHAREHOLDER RESOLUTIONS IN THE GMBH USING THE EXAMPLE OF THE LEGAL DISPUTE BETWEEN MARTIN KIND AND “HANNOVER 96”

If shareholders of a GmbH (limited liability company) violate the allocation of powers set out in the articles of association and a voting agreement under the law of obligations with non-shareholders when passing a resolution on the dismissal of the managing director, this does not generally result in this resolution being null and void or voidable. This is the subject of a recent ruling by the BGH (judgment of 16 July 2024 – II ZR 71/23).

I. Introduction and background

Contractual agreements in which shareholders coordinate their voting behavior in the shareholders’ meeting with other shareholders or third parties are not uncommon in practice. Due to their purely contractual nature, such voting agreements generally only have effect between the parties to these agreements. The question therefore arises as to how a breach of a voting agreement affects the validity of the shareholder resolution in question. The BGH recently ruled on this question and took the opportunity to also comment on other questions of validity relating to shareholder resolutions of a GmbH. The decision deserves attention not only because of its publicity, which is due to the media presence of the parties involved in connection with the match operations of the second division soccer club Hannover 96, but above all from a corporate law perspective.

II. Nullity and contestability of shareholder resolutions

As the GmbHG (German Law on Limited Liability Companies) does not contain any provisions on the validity of shareholders’ resolutions, the regulations on stock corporations apply accordingly to GmbHs (BGH, judgment of 17 February 1997 – II ZR 41/96). Accordingly, a distinction must be made between nullity and contestability of a shareholders’ resolution. A shareholders’ resolution that violates one of the provisions listed in § 241 AktG (German Stock Corporation Act) is null and void and has no effect from the outset. The grounds for nullity contained in § 241 AktG include, in particular, defects in the convening of the meeting, failure to comply with the duty of notarization (§ 53 para. 3 sentence 1 GmbHG) or serious defects in content (e.g. a breach of the creditor-protecting provisions on capital maintenance pursuant to § 30 GmbHG). The nullity can be established in court by means of an action for nullity analogous to § 249 AktG. All other defects in a resolution, such as breaches of provisions in the articles of association or statutory provisions, which do not already lead to the nullity of a resolution in accordance with § 241 AktG analogously, generally (only) entitle the resolution to be contested in accordance with § 243 AktG analogously. A contestable resolution is generally effective as long as it is not successfully challenged in a timely manner with an action for rescission.

The BGH (judgement of 14 November 1983 – II ZR 33/83) grants not only the shareholders but also the managing directors and at least the supervisory board of a GmbH subject to the co-determination laws the right to bring an action for a declaration of nullity. However, only the shareholders of a GmbH are authorized to bring an action for rescission, but not the managing directors, the supervisory board or its members.

III. Agreements under the law of obligations

Not all regulations concerning the shareholders and the company have to be agreed in the articles of association. Agreements are also permitted outside the company level, for example in contracts under the law of obligations (also known as “shareholder agreements”). Such shareholder agreements offer a high degree of flexibility compared to provisions in the articles of association and guarantee confidentiality, as they do not have to be published in the commercial register. In terms of content, such shareholder agreements primarily contain provisions on the exercise of membership rights (e.g. voting agreements) or agreements on the shares (e.g. purchase, pre-emption or tender rights).

The violation of shareholder agreements does not generally constitute a valid reason for contesting a shareholder resolution. This is undisputed as far as shareholder agreements are concerned in which not all shareholders (and possibly also the company) are involved. The legal options for action on questions of compliance with or breach of shareholders’ agreements are limited to the group of parties to such a shareholders’ agreement. Depending on the subject matter, the parties involved can therefore bring an action before the competent courts against the contracting party in breach of the agreement, for example for injunctive relief and/or damages. In an older decision, the BGH (judgment of 20 January 1983 – II ZR 243/81) stated for reasons of procedural economy that a breach of a shareholders’ agreement by all shareholders may also entitle one of the outvoted shareholders to challenge a shareholders’ resolution in individual cases.

IV. BGH decision

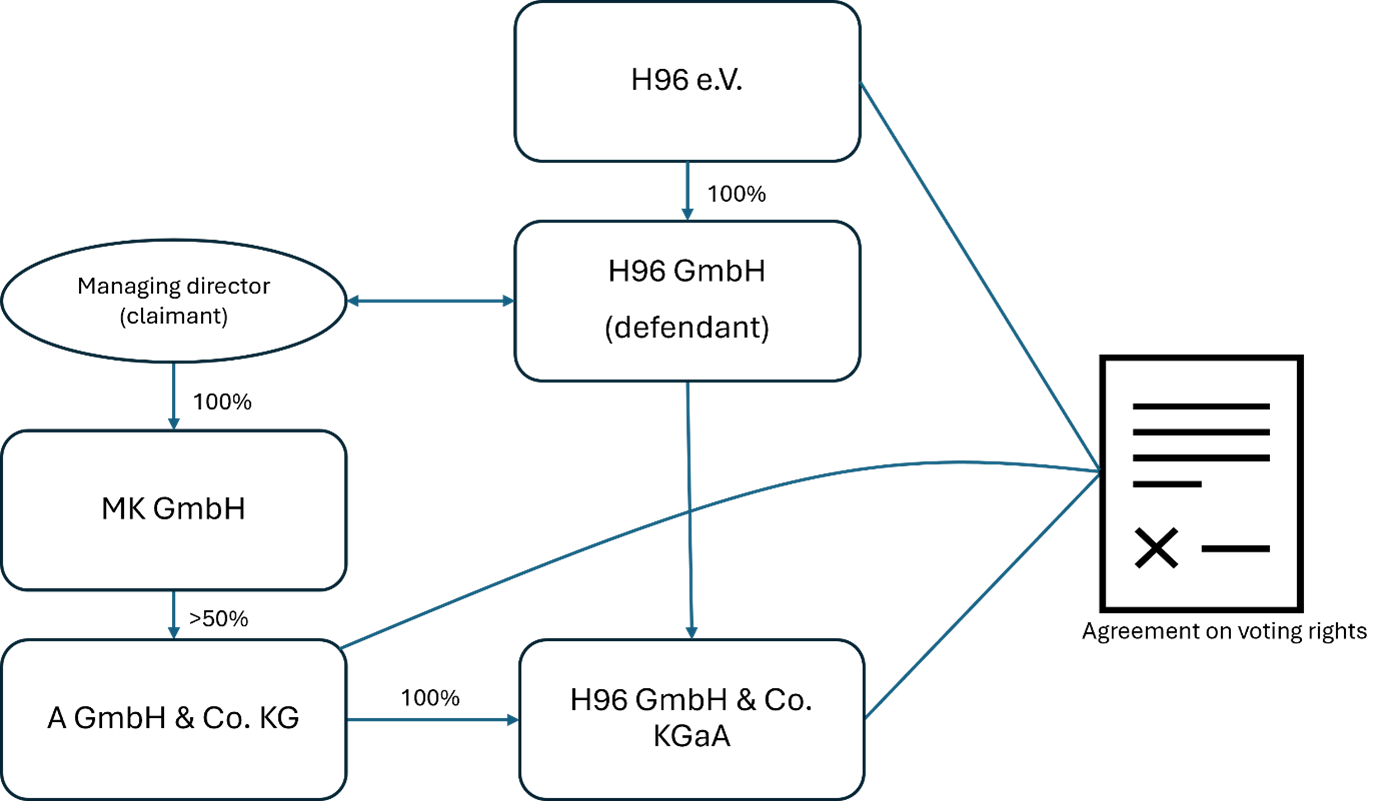

The new decision of the BGH (judgment of 16 July 2024 – II ZR 71/23) was essentially based on the following facts. The two sole shareholders of H96 GmbH & Co. KGaA (“KGaA”) are A GmbH & Co. KG (“KG”) as limited partner and H96 GmbH as general partner. The sole shareholder of H96 GmbH is H96 e.V. (a registered association). The claimant was the managing director of the defendant H96 GmbH. At the same time, the claimant is the indirect majority shareholder of the KG.

The articles of association establish a four-member Supervisory Board at H96 GmbH, half of which consists of members delegated by the KGaA. The articles of association of H96 GmbH also give the Supervisory Board the authority to appoint and dismiss managing directors. In addition, H96 e.V., the KGaA and the KG had contractually agreed that H96 e.V., as the sole shareholder of H96 GmbH, may not amend the articles of association of H96 GmbH without the prior consent of the KGaA and the KG.

At an extraordinary shareholders’ meeting held by the sole shareholder H96 e.V., the claimant was dismissed as managing director of H96 GmbH by notarized resolution. With his action, the claimant seeks a declaration that this shareholders’ resolution is null and void.

The Higher Regional Court of Celle upheld the action on appeal and stated, among other things, that the dismissal resolution was null and void by analogy with § 241 no. 3 and no. 4 AktG, as it was passed in breach of competence and in deliberate violation of the voting trust agreement. The claimant did not have to rely on the parties to the voting trust agreement to assert the breach of the voting trust agreement but could take direct action against the shareholder resolution and the defendant.

These statements did not stand up to review by the BGH. In the opinion of the BGH, the shareholder resolution and thus the dismissal of the claimant as managing director was effective. The BGH ruled that the claimant, as a non-shareholder, could not take legal action against the resolution, as the dispute regarding the existence and legal consequences of a breach of the voting agreement was to be settled between the parties to the voting agreement and not with the company. For a non-shareholder, a dispute with the other parties to a voting trust agreement is also the only way to enforce agreements under the law of obligations with a sole shareholder. It is out of the question for an agreement under the law of obligations with a non-shareholder to be passed on to the corporate level. Furthermore, the BGH clarifies in its decision that no nullity pursuant to § 241 no. 3 AktG follows from a breach of the voting trust agreement, as the observance of voting trust agreements is not one of the fundamental structural principles of GmbH law. An immorality due to a deliberate breach of the voting agreement could also not lead to the nullity of the shareholder resolution, as this would mix the level of the law of obligations and corporate law.

The mere violation of a provision in the articles of association makes a shareholder resolution contestable, but not void. Since, in the event of a conflict of competence between the shareholders’ meeting and the optional supervisory board, neither the supervisory board as such nor its members are generally entitled to challenge resolutions adopted in breach of competence, the company body affected by the resolution adopted in breach of competence (in this case the supervisory board) must accept this breach of the articles of association. Such an incompetent resolution would also not result in nullity due to immorality. This is because the shareholders’ meeting would always have the option of “reclaiming” the authority to dismiss and appoint the managing director by amending the articles of association. Furthermore, in the opinion of the BGH, if the powers under the articles of association are only interrupted selectively by resolution (interruption of the articles of association), no regulatory content can be inferred from this that would permanently change the internal “balance of power” and accordingly create a permanent effect. Therefore, notarization of the resolution breaking through the articles of association (in accordance with the formal requirement for amendments to the articles of association) would not have been necessary.

V. Outlook and consequences for the practice

The decision underlines the position of the shareholders’ meeting as the supreme body of the GmbH. It shows that the powers of the shareholders’ meeting enjoy a high status, which cannot be easily undermined by other allocations of powers or ancillary agreements under the law of obligations. Furthermore, the BGH clarifies that ancillary agreements under the law of obligations with third parties, even if all shareholders (or a sole shareholder) are involved in them, cannot soften the boundary between the level of the law of obligations and the corporate level by allowing third parties to directly influence the company’s processes by way of legal action. Nevertheless, the decision must not be understood as a free pass to make shareholder resolutions without regard to their requirements under company law or existing obligations under the law of obligations. Even if the action brought by the dismissed managing director ultimately was not successful, the proceedings nevertheless show the dangers, particularly in the form of protracted litigation, that a controversial shareholder resolution that violates competence regulations or ancillary agreements under the law of obligations can entail.

We are here for you

For more information please contact

Nick Miller

honert hamburg

Attorney-at-Law, Wirtschaftsjurist (univ. Bayreuth), LL.B. (Recht & Wirtschaft)

Gesellschaftsrecht, Allgemeines Wirtschaftsrecht, Transaktionen (M&A), Nachfolge

| phone | +49 (40) 380 37 57 0 |

| [email protected] |

Dr. Jörg Schwichtenberg

honert munich

Partner, Attorney-at-Law

Corporate, Business Law, Compliance, Capital Markets, Litigation

| phone | +49 (89) 388 381 0 |

| [email protected] |

Dr. Jörn-Ahrend Witt

honert hamburg

Partner, Attorney-at-Law

M&A, Corporate, Business Law

| phone | +49 (40) 380 37 57 0 |

| [email protected] |